The Good, the Bad, and the Ugly in the Fiscal Cliff Package

Last night, the Senate voted on and approved a package to avert most components of the fiscal cliff, which we took a preliminary review of last night. Today, however, there are many more details to review now that the legislation is available and JCT has estimated the revenue effects.

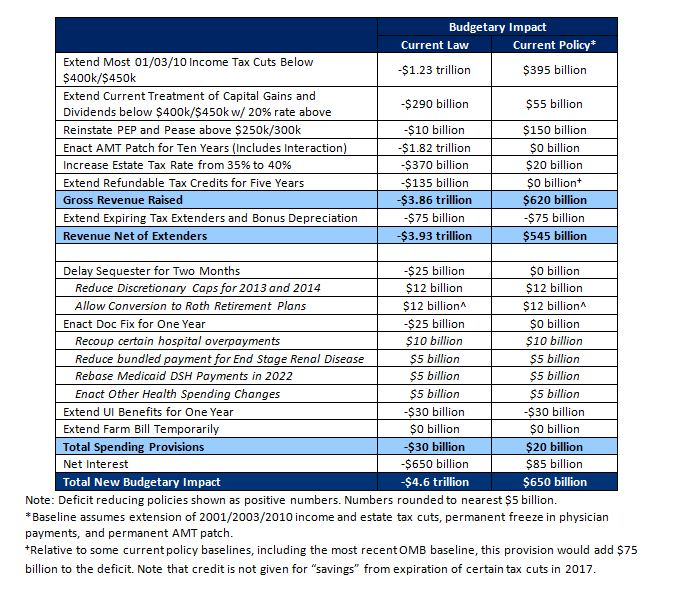

In short, the package would permanently extend most of the 2001/2003/2010 tax cuts for incomes below $400,000/$450,000 while letting the ordinary rate above that threshold rise to 39.6 percent and the capital gains and dividends rates to 20 percent; it would increase the estate tax rate from 35 to 40 percent; it would permanently patch the AMT; and it would extend various “tax extenders” for 2012 and 2013. On the spending side, the package would delay the sequester for two months, enact a doc fix for a year, extend unemployment benefits for a year, extend the farm bill for a year, and enact about $50 billion in spending and revenue offsets to pay for the sequester delay and doc fix.

Based on more recent estimates, CRFB estimates that the entire package would increase deficits by about $4.6 trillion over the next ten years compared to current law projections (assuming everything expires or activates as called for) but would decrease deficits and debt by about $650 billion compared to more realistic current policy projections. These revised estimates continue to show that debt would remain on a upward path over the next ten years -- reaching 79 percent of GDP by 2022 – if policymakers are unable to offset a repeal of the sequester and Sustainable Growth Rate. That would be a slight improvement over the CRFB Realistic Projections, which show debt rising to over 81 percent by 2022. Clearly, lawmakers will need to go further, however, to put in place much more savings.

Below is our effort to roughly estimate the parameters of the deal.

Savings and Costs in the Fiscal Cliff Package

So what’s to like and dislike about the deal? Below we explain:

The Good

- Avoids most of the abrupt economic harm from the fiscal cliff by extending or delaying most provisions

- Raises $620 billion in gross revenues relative to current policy, which would contribute to reducing the deficit compared to current policy

- Sets the precedent that extending the sequester has to be paid for and strengthens the precedent that the doc fix should be waived only along with offsetting health provisions

- Leaves in place the ability for lawmakers to discuss further and more meaningful deficit reduction measures in the coming weeks in order to avoid sequestration in the beginning of March

The Bad

- Does not put in place the measures necessary to stabilize the debt as a share of the economy, let alone reduce it

- Does not include any serious entitlement reforms or set up a clear process for considering such reforms even though rising health costs remain our largest single fiscal challenge on Social Security is on a road toward insolvency

- Does not include a process to enact pro-growth and revenue generating tax reforms

- Does not specifically offset the costs of the tax extenders or UI benefits, setting a bad precedent for future extensions

The Ugly

- Uses a tax timing gimmick to pay for part of the sequester. Specifically, it raises $12 billion by allowing people to convert certain retirement accounts to "Roth" accounts so that they can pay their taxes now instead of later

- Cuts taxes by almost $4 trillion relative to current law projections, with a permanent resolution to the 01/03/10 tax cuts and AMT enacted on a deficit-financed basis even when deficit reduction needs have not been met

- Represents an incredible failed opportunity by missing what Erskine Bowles calls a “magic moment” to put in place a comprehensive plan that would simultaneously avoid the fiscal cliff and more importantly enact the spending cuts, tax reforms, and entitlement reforms necessary to truly control rising debt

CRFB hopes that lawmakers will return the table very quickly in the new year to enact savings sufficient in size and scope to solve the country's debt problems.